Everyday expenses can quietly drain your wallet before you even notice. But what if 10 simple ways to save money on everyday expenses could turn that around—without drastic lifestyle changes or complicated budgets? Whether you’re juggling bills, trying to chip away at debt, or just aiming to build a safety net, these practical, easy-to-follow tips are designed to help you keep more cash without feeling deprived. Ready to unlock quick wins that add up to real savings? Let’s get started!

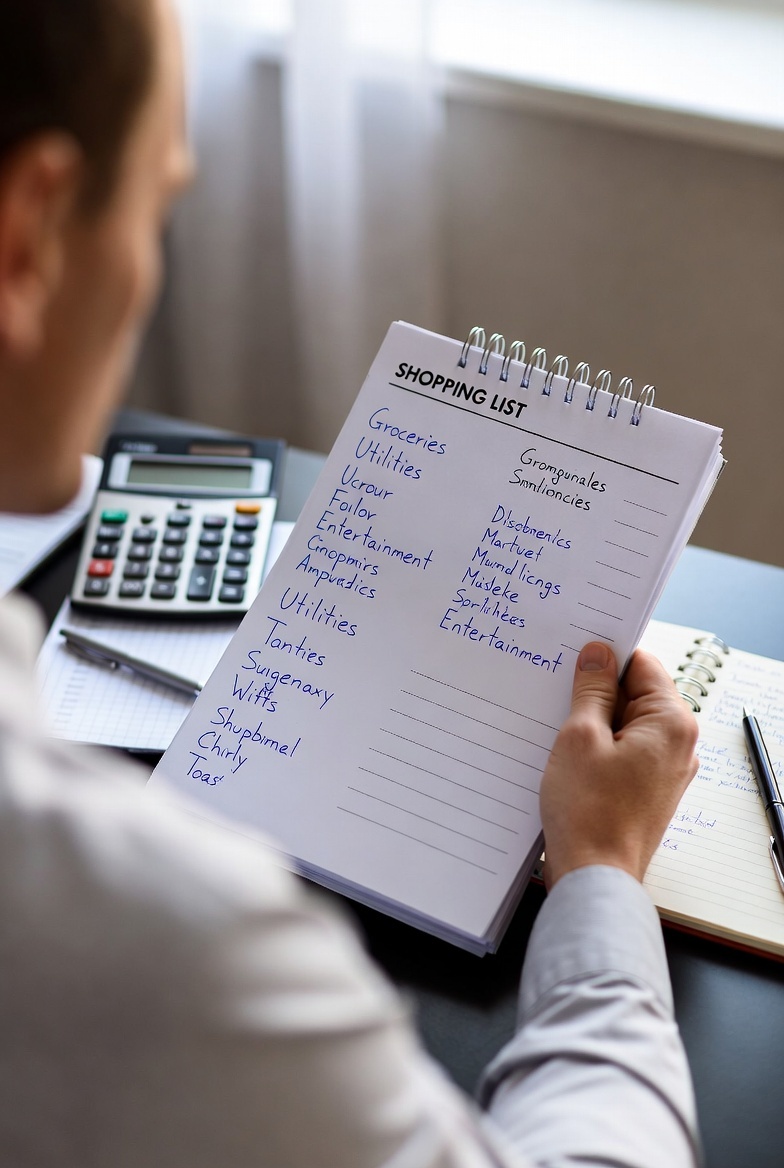

Track Your Spending to Uncover Hidden Costs

Ever wonder where your money really goes each month? Tracking your spending is the key to finding hidden expenses that quietly drain your wallet. Awareness is the foundation of saving, so the first step is knowing exactly what you’re spending and why.

How to Get Started:

- Use a spending tracker app, a simple spreadsheet, or even a notebook.

- Track every expense for 30 days—yes, every coffee, subscription, and snack.

- Categorize your purchases into needs (rent, groceries) and wants (streaming services, impulse buys).

Why It Works:

When you see your spending laid out, it’s easier to spot money leaks. You may discover forgotten subscriptions, like a gym membership you don’t use, or impulse purchases that add up without you noticing.

Real Savings Example:

If you find you’re paying $15 a month for a service you never use, canceling it could save $180 a year without any extra effort.

Tracking spending isn’t about feeling restricted—it’s about empowering yourself to take control. Once you catch those hidden costs, you can start making smarter choices and saving more every day.

Create a Realistic Budget and Stick to It

A solid budget is key to cutting daily expenses and saving money on everyday costs. One simple way to start is by using the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings. This framework keeps things clear and manageable without overcomplicating your finances.

For better success, automate your savings by transferring that 20% to a separate account right when you get paid. This “pay yourself first” approach ensures saving isn’t skipped. Reviewing your budget weekly helps spot overspending early and make quick adjustments.

Following a realistic budget stops impulse buying and unnecessary splurges, which often eat into your funds. For those new to budgeting or who find it frustrating, resources like this guide on how to hate budgeting but still succeed can make the process easier and more approachable.

Master Grocery Shopping and Meal Planning

Meal planning is a simple but powerful way to save money on groceries. Start by planning your meals for the week, then shop with a detailed list to avoid impulse buying. Sticking to your list helps cut down on unnecessary purchases and keeps you focused on your budget.

To save even more, opt for generic brands instead of name brands—they usually offer the same quality at a lower price. Keep an eye out for sales and discounts on items you regularly use. Another smart move is to use leftovers creatively, which reduces food waste and the need to eat out.

For an extra boost to your savings, try batch cooking. Preparing meals in larger quantities can cut down dining-out expenses and prevent last-minute takeout splurges. This approach not only saves money but also saves time during busy weekdays.

Learning to save on groceries and meal planning fits right into practical everyday money hacks, making a real difference in your monthly spending.

For more insights on managing your money wisely, exploring why financial mistakes happen can be eye-opening and help you avoid common pitfalls.

(See how understanding why financial mistakes are unavoidable can improve your budgeting efforts here.)

Cut Back on Eating Out and Coffee Runs

One of the easiest ways to cut daily expenses is by reducing how often you eat out or grab coffee on the go. Brewing your coffee at home can save you a surprising amount each month, especially if you’re used to daily coffee runs. Packing lunches instead of buying food during work or school breaks helps you avoid the impulse buying that often breaks the budget.

Try to limit restaurant visits to special occasions only. When you do dine out, use rewards apps or loyalty programs to get discounts, cashback, or freebies. Over time, these small habits can save hundreds per month for frequent diners without sacrificing enjoyment.

For more ways to stretch your budget and make smart financial choices, check out our guide on how to buy real estate when funds are limited. It’s all about smart planning, just like cutting back on everyday expenses.

Reduce Utility Bills with Easy Habits

Cutting daily expenses like utility bills doesn’t have to be hard. Start by switching to energy-efficient bulbs—they use less power and last longer. Unplug devices and chargers when not in use to avoid “phantom” energy drain. Make sure to run full loads in your dishwasher and washing machine to get the most out of each cycle.

Adjust your thermostat by a few degrees lower in winter and higher in summer; even small changes can add up over time. Try doing heavy-energy tasks, like laundry or dishwashing, during off-peak hours if your utility provider offers lower rates.

In the long run, swap disposable household items for reusable ones to reduce waste and save money. Simple actions like these build up to consistent home energy savings without much effort. For more on practical money habits, check out this insightful post on balancing your work and finances wisely.

Optimize Transportation Costs

Transportation can be a big chunk of your monthly expenses, but there are simple ways to cut back without much hassle. Start by combining errands into one trip to save on gas and time. Carpooling with coworkers or friends not only lowers fuel costs but also reduces wear and tear on your vehicle. For short trips, consider walking, biking, or using public transit — these options are often cheaper and better for the environment.

Keeping your vehicle in good shape can improve fuel efficiency significantly. Regular maintenance like tire checks and oil changes helps you get more miles per gallon. Also, use apps that compare gas prices nearby to fill up at the cheapest stations.

If your job allows, working remotely can save commuting costs entirely. Even switching to biking for part of your route can add up to big savings in the long run.

If you want more tips on saving around the home and everyday living, check out how your house might be increasing costs unexpectedly in this detailed look at home energy savings and frugal living tips.

Cancel Unused Subscriptions and Negotiate Bills

One quick way to cut daily expenses is by canceling subscriptions you no longer use or need. Take a close look at your streaming services, gym memberships, and app subscriptions—many of us keep paying for things out of habit. Keeping only the essentials can immediately free up monthly cash.

Once you’ve trimmed unused services, it pays to call your internet, phone, and insurance providers to negotiate lower rates. Often, companies offer discounts or better plans if you ask—don’t be shy about requesting a deal or threatening to switch. When contracts allow, consider switching to cheaper alternatives without sacrificing quality.

For more on managing bills and understanding how interest rates impact your finances, check out this guide on why a fixed rate mortgage is beneficial. It explains key financial strategies that can help you keep bills predictable and savings steady.

Shop Smarter with Cashback, Coupons, and Rewards

Saving money on everyday expenses gets easier when you use cashback apps, credit cards (paid in full each month), and store loyalty programs. These tools give you money back or discounts on purchases you’d make anyway. Before buying, always compare prices online to find the best deal, and consider buying non-perishable items in bulk to save more over time.

To avoid impulse spending, try waiting 30 days before making non-essential purchases. This simple delay can stop unnecessary buys and build better spending habits. For more insights on how even smart people can improve their money habits, check out this article on why smart people are still stuck financially. Using everyday money hacks like these can add up to significant savings each month.

Embrace Reusable and DIY Solutions

Switching to reusable bags, bottles, and containers is an easy way to cut down on daily expenses from constantly buying disposable items. These simple swaps not only save money but also reduce waste, making them a smart choice for both your budget and the environment.

You can also learn basic home repairs with free online tutorials, which often helps avoid costly handyman fees. DIY cleaning solutions made from common household ingredients like vinegar and baking soda work great and cost much less than commercial cleaners.

When shopping, focus on quality over quantity. Buying durable items that last longer means fewer replacements and less spending in the long run. These everyday money hacks add up quickly, helping you build a more frugal lifestyle without sacrificing convenience or comfort.

For more on building smart habits that pay off over time, you might find useful insights in what I’ve learned from building financial discipline here.

Build Habits for Long-Term Savings

Building strong money habits is key to saving consistently over time. Start by paying yourself first—automate transfers to your savings account as soon as you get paid. This simple step ensures you prioritize saving before spending.

Try setting small challenges like no-spend weeks where you only buy essentials. These mini goals help curb impulse buying and boost your awareness of spending habits.

Don’t forget to celebrate your progress. Recognizing milestones, no matter how small, keeps motivation high and reinforces positive behavior for lasting financial health.

For more insights on shifting your mindset toward wealth, check out this practical wealth-building shift guide, which complements everyday money hacks for long-term success.